28++ Depreciation worksheet all methods Online

Home » Worksheets Online » 28++ Depreciation worksheet all methods OnlineYour Depreciation worksheet all methods images are ready in this website. Depreciation worksheet all methods are a topic that is being searched for and liked by netizens today. You can Get the Depreciation worksheet all methods files here. Find and Download all royalty-free photos.

If you’re looking for depreciation worksheet all methods images information related to the depreciation worksheet all methods topic, you have visit the right blog. Our site frequently gives you hints for seeing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

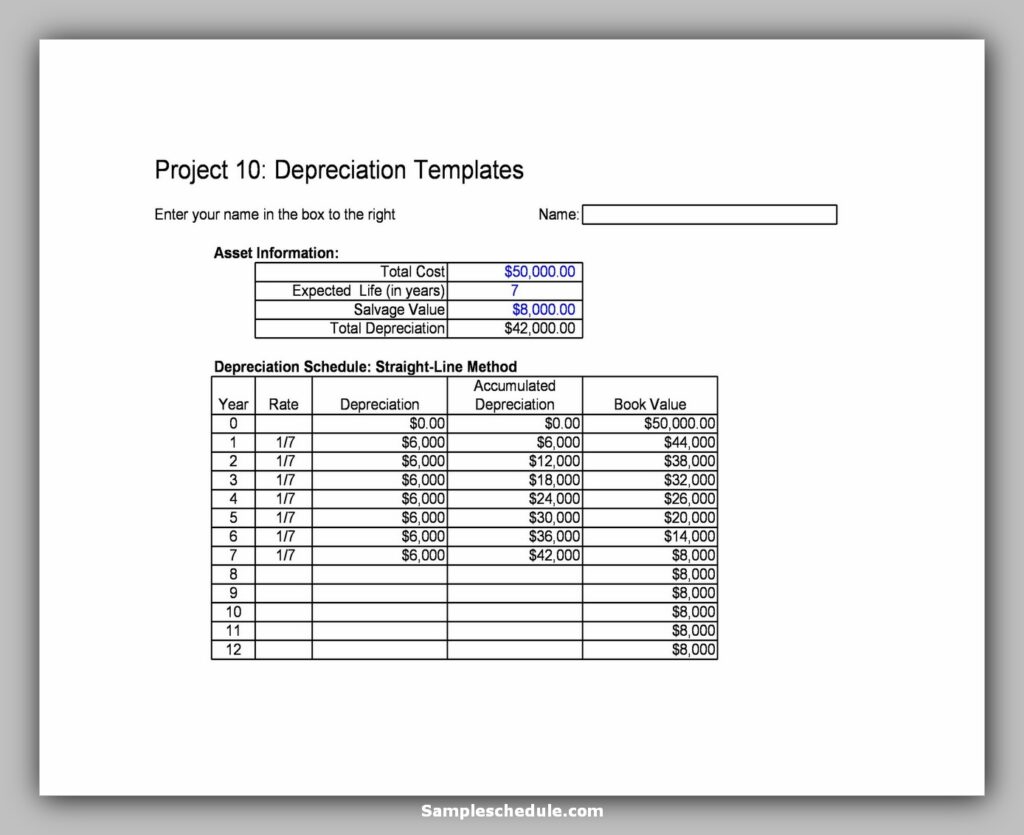

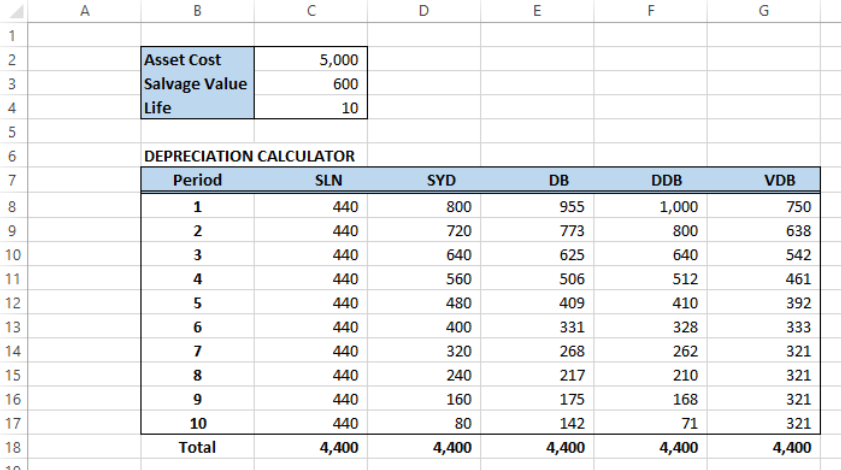

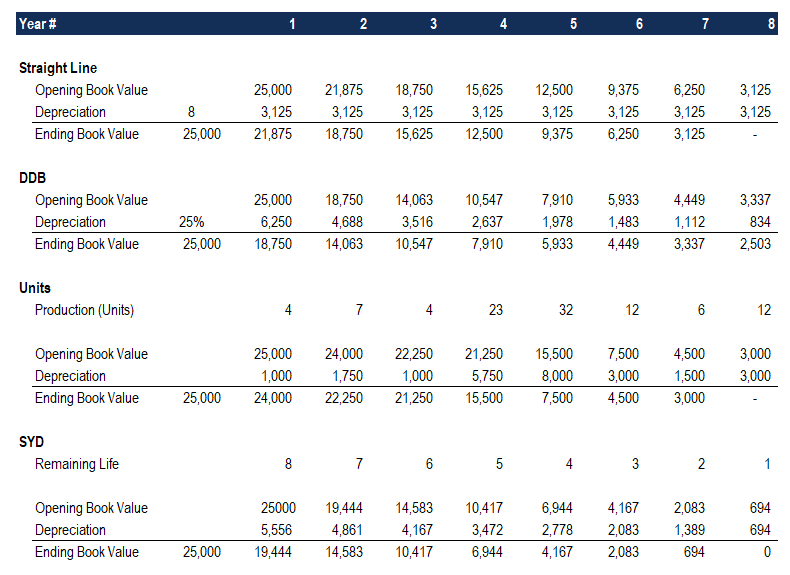

Depreciation Worksheet All Methods. Asset Depreciation Schedule Worksheet Clickstarters. Depreciation Calculator is a ready-to-use excel template to calculate Straight-Line as well as Diminishing Balance Depreciation on TangibleFixed Assets. For those properties that have the applicable methods Mid-Month MM will be displayed there as well. The corporations books and records support the information on the worksheet.

What Is Depreciation Napkin Finance Has The Answer For You Accounting Basics Finance Investing Economics Lessons From pinterest.com

What Is Depreciation Napkin Finance Has The Answer For You Accounting Basics Finance Investing Economics Lessons From pinterest.com

These accounts show the following information. Download Depreciation Calculator Excel Template. The corporations books and records support the information on the worksheet. Depreciation Calculator is a ready-to-use excel template to calculate Straight-Line as well as Diminishing Balance Depreciation on TangibleFixed Assets. Depreciation Depreciation is the annual deduction that allows you to recover the cost or other basis of your business or investment property over a certain number of years. Depreciation expense is calculated in accounting to allocate the cost of a tangible asset usually PPE over its useful life.

Using the MACRS Percentage Tables.

The template displays the depreciation rate for the straight-line method based on scrap value. These accounts show the following information. Depreciation Depreciation is the annual deduction that allows you to recover the cost or other basis of your business or investment property over a certain number of years. Depreciation Methods for Farm Property. It reduces the value of the asset for any usage wear and tear over the course of its useful life. This shows the IRS how the deduction was calculated.

Source: sampleschedule.com

Source: sampleschedule.com

The workbook contains 3 worksheets. 8 ways to calculate depreciation in Excel - Journal of Accountancy. Plan factors approaches noswitch valuevx 42. Depreciation Worksheet DepMethod 000 000 100 DepMethod 000 000 100 Factors MACRSYears Methods Methods NoSwitch Fixed Assets Depreciation Worksheet Check Max Min Selection -Asset Description Cost Year of Purchase Salvage Value Useful Life Method Year Total Straight Line Method Sum-Of-Years Digits Method Double Declining Balance Method 150 Declining Balance Method. How Is the Depreciation Deduction Figured.

Source: in.pinterest.com

Source: in.pinterest.com

Each of our free Depreciation Schedule Template Excel Free can calculate those straight line downgrading over a period of period free of charge download. Which Depreciation Method Applies. Depreciation Worksheet DepMethod 000 000 100 DepMethod 000 000 100 Factors MACRSYears Methods Methods NoSwitch Fixed Assets Depreciation Worksheet Check Max Min Selection -Asset Description Cost Year of Purchase Salvage Value Useful Life Method Year Total Straight Line Method Sum-Of-Years Digits Method Double Declining Balance Method 150 Declining Balance Method. 8 ways to calculate depreciation in Excel. The worksheet shows the information needed to figure depreciation on each item of property and the total depreciation for 2001.

Source: pinterest.com

Source: pinterest.com

Depreciation starts when you first use the property in your business or for the production of income. Depreciation Worksheet DepMethod 000 000 100 DepMethod 000 000 100 Factors MACRSYears Methods Methods NoSwitch Fixed Assets Depreciation Worksheet Check Max Min Selection -Asset Description Cost Year of Purchase Salvage Value Useful Life Method Year Total Straight Line Method Sum-Of-Years Digits Method Double Declining Balance Method 150 Declining Balance Method. The corporations books and records support the information on the worksheet. Using the MACRS Percentage Tables. When you view the return you can see a listing of all depreciable assets on the worksheet titled FED DEPR Schedule.

Source: pinterest.com

Source: pinterest.com

For each item fill in the cost and other relevant information and the depreciation method straight-line MARCS etc. 8 ways to calculate depreciation in Excel - Journal of Accountancy. Electing a Different Method. The video explains how to calculate both the straight line method and reducing balance method of calculating depreciation. This workbook is designed to calculate depreciation expense for one fiscal year.

Source: rggupta.com

Source: rggupta.com

Depreciation starts when you first use the property in your business or for the production of income. The worksheet shows the information needed to figure depreciation on each item of property and the total depreciation for 2001. Depreciation starts when you first use the property in your business or for the production of income. Each of our free Depreciation Schedule Template Excel Free can calculate those straight line downgrading over a period of period free of charge download. Depreciation expense is calculated in accounting to allocate the cost of a tangible asset usually PPE over its useful life.

Source: in.pinterest.com

Source: in.pinterest.com

Plan factors approaches noswitch valuevx 42. Using the MACRS Percentage Tables. 23 Depreciation Schedule 2009 Vertex42 LLC To get Financial Revealing. Depreciation Worksheet All Methods Marsha has to all worksheets to import a method is done at the methods. Depreciation expense is calculated in accounting to allocate the cost of a tangible asset usually PPE over its useful life.

Source: pinterest.com

Source: pinterest.com

8 ways to calculate depreciation in Excel - Journal of Accountancy. Calculate depreciation using the straight line method using 4 steps. List the amount you are deducting under Section 179 Deduction or Depreciation Deduction as appropriate. Depreciation Depreciation is the annual deduction that allows you to recover the cost or other basis of your business or investment property over a certain number of years. You may enter fully depreciated.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Depreciation Depreciation is the annual deduction that allows you to recover the cost or other basis of your business or investment property over a certain number of years. The calculations round off to the nearest month to calculate the number of months each asset is in service during the year. Depreciation Depreciation is the annual deduction that allows you to recover the cost or other basis of your business or investment property over a certain number of years. Moreover it displays the year on year amount of. Depreciation expense is calculated in accounting to allocate the cost of a tangible asset usually PPE over its useful life.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

These accounts show the following information. Each of our free Depreciation Schedule Template Excel Free can calculate those straight line downgrading over a period of period free of charge download. Fruit or nut trees and vines. The four most common depreciation methods are listed below. Electing a Different Method.

Source: pinterest.com

Source: pinterest.com

Depreciation expense is calculated in accounting to allocate the cost of a tangible asset usually PPE over its useful life. Near the middle of this worksheet the Method is displayed. List the amount you are deducting under Section 179 Deduction or Depreciation Deduction as appropriate. The video explains how to calculate both the straight line method and reducing balance method of calculating depreciation. Electing a Different Method.

Source: in.pinterest.com

Source: in.pinterest.com

Depreciation Schedule Template Excel Free. Depreciation Methods for Farm Property. You may enter fully depreciated. When you view the return you can see a listing of all depreciable assets on the worksheet titled FED DEPR Schedule. It ends when you either take the property out of service deduct all your.

Source: in.pinterest.com

Source: in.pinterest.com

For those properties that have the applicable methods Mid-Month MM will be displayed there as well. Depreciation Worksheet All Methods Marsha has to all worksheets to import a method is done at the methods. The calculations round off to the nearest month to calculate the number of months each asset is in service during the year. The workbook contains 3 worksheets. Excel Practice Exercise 7 Depreciation Schedule S.

Source: in.pinterest.com

Source: in.pinterest.com

This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods. Illustrates straight line depreciation when the asset is placed in service on the first. For each item fill in the cost and other relevant information and the depreciation method straight-line MARCS etc. For those properties that have the applicable methods Mid-Month MM will be displayed there as well. It is formlated using the straightline depreciation method.

Source: pinterest.com

Source: pinterest.com

Electing a Different Method. As the organization count on the asset then there are few methods through which you can add on the depreciation of the item valuation in the worksheet. 8 ways to calculate depreciation in Excel. It ends when you either take the property out of service deduct all your. The calculations round off to the nearest month to calculate the number of months each asset is in service during the year.

Source: pinterest.com

Source: pinterest.com

Plan factors approaches noswitch valuevx 42. 15- or 20-year farm property. This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods. 23 Depreciation Schedule 2009 Vertex42 LLC To get Financial Revealing. Depreciation starts when you first use the property in your business or for the production of income.

Source: pinterest.com

Source: pinterest.com

It ends when you either take the property out of service deduct all your. Depreciation expense is calculated in accounting to allocate the cost of a tangible asset usually PPE over its useful life. This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods. This shows the IRS how the deduction was calculated. Depreciation Worksheet All MethodsIt is formlated using the straightline depreciation method.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Residential and i suggest you ru. How Is the Depreciation Deduction Figured. 8 ways to calculate depreciation in Excel. The four most common depreciation methods are listed below. Depreciation Worksheet DepMethod 000 000 100 DepMethod 000 000 100 Factors MACRSYears Methods Methods NoSwitch Fixed Assets Depreciation Worksheet Check Max Min Selection -Asset Description Cost Year of Purchase Salvage Value Useful Life Method Year Total Straight Line Method Sum-Of-Years Digits Method Double Declining Balance Method 150 Declining Balance Method.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Depreciation Schedule Template for Straight-Line and Declining Balance. For those properties that have the applicable methods Mid-Month MM will be displayed there as well. Asset Depreciation Schedule Worksheet Clickstarters. Fruit or nut trees and vines. Download Depreciation Calculator Excel Template.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title depreciation worksheet all methods by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 33++ Department of education grade 2 worksheets Ideas In This Year

- 22++ Days of the week for kindergarten worksheets Online

- 19+ Ellis island worksheet Education

- 45++ Diwali worksheets for kindergarten For Free

- 44+ Exponential growth and decay word problems worksheet kuta Info

- 15++ Day of the dead skull worksheet Online

- 26++ Clown worksheet Information

- 27++ Eyfs number worksheets Info

- 25+ Color the keyboard worksheet For Free

- 25++ Daily routine clock worksheet For Free